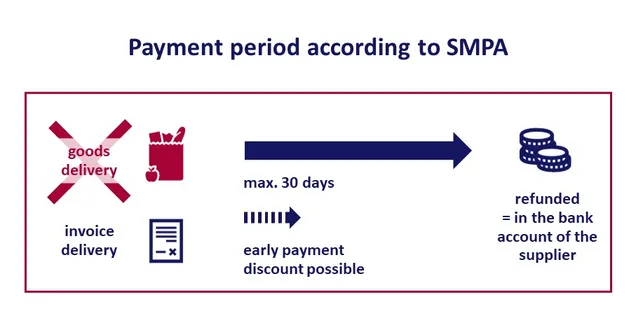

There are 30 days left until the end of the year at the time of publishing this article. Thirty days is the payment period that buyers with significant market power should apply in their contracts with the affected suppliers of food and agricultural products from 1 January. And not only on paper. We are bringing you the fourth part of our SMPA miniseries, this time on the maximum time limit for the payment of invoices in supplier-customer relationships.

According to the SMPA, the payment period for the purchase of food and agricultural products is considered one of the essential elements of any contract between the buyer with significant market power and the suppliers towards whom the buyer has such a position. The maximum payment period of 30 days applies to all payments for the supply of food and agricultural products purchased by the buyer with significant market power from these suppliers.

In this case, the amendment has not brought about any changes. However, the extension of the applicability of the SMPA to the whole food chain means that the payment period limitation now applies to wide range of previously unaffected undertakings. As the Office for the Protection of Competition (the "Office") found in a sector inquiry a year ago (see our blog), the payment period for some of the new addressees of the obligations reached up to 120 days and were in practice sometimes artificially extended.

So it could be a really serious issue. After all, the very first fine ever imposed for a breach of the SMPA was, among other things, for exceeding the maximum payment period[1]. Although the Office's decision was later overturned by the Court[2], it is expected that this issue will be a priority for the Office even after the amendment becomes fully effective on 1 January 2024.

Let's take a look at how to properly set the payment period, not only in the contract, but also how to ensure that it works in practice.

Invoicing as the basis

The legal basis for the payment of the purchase price can be found in the Civil Code (the “CC”). If the period is not expressly agreed in the contract, it shall be 30 days. The time limit shall run from the date of delivery of the invoice or from the date of receipt of the goods or services, depending on which is the later (In the case of agreed arrangements for acceptance or inspection of the goods, the time limit shall commence from the date of their execution).

Entrepreneurs may agree on a shorter or longer payment period than 30 days, but if the payment period is longer than 60 days, such an arrangement must not be manifestly unfair to the creditor. They are also free to choose the moment from which the time limit begins to run.

The SMPA significantly reduces these options in the relationship between a buyer with significant market power and suppliers vis-à-vis whom the buyer has such a position. First of all, the payment period must always be explicitly agreed (it is a mandatory part of the contract according to the SMPA). Irrespective of the nature of the food or agricultural products (e.g. whether they are perishable) or the regularity of the deliveries, a maximum payment period of 30 days applies, always counted from the date of receipt of the invoice.

Setting the time period solves all the problems, doesn't it?

Apart from the length of the payment period in question, contracts between a buyer with significant market power and a supplier must sufficiently specify the form in which payments are to be made. Although the main methods will be cash and bank transfers, the SMPA does not exclude other payment methods, such as the arrangement of documentary payments, i.e. direct debit or letter of credit. The parties should also remember to identify the payment accounts to which all the invoices are to be paid[3].

The choice of method of payment is left to the contracting parties, however, it must be explicitly stated in the contract. At the same time, please note that the method of payment must not affect payment within 30 days of receipt of the invoice. The moment of payment is generally considered to be the moment when the financial means are made available to the supplier.

It is also still possible to negotiate a discount on the purchase price for early payment of the invoice. However, the original length of the payment period (i.e. the period before the early payment is applied) may not exceed 30 days in such a case. The discount itself is a service provided by the buyer (more on services next time) and the amount of the required discount (i.e. the price reduction) must not be disproportionate.

The SMPA also leaves the question of the timing of the issue and delivery of the invoice in relation to the time of delivery of the goods to the agreement between the customer and the supplier. The invoice can be delivered before the goods are supplied (it may also be a Pro-forma invoice). Alternatively, it can be agreed that the invoice will only be delivered after the agreed products have been supplied.

Not just on paper, but also in practice

So if you have a payment period in your contract that is in line with the SMPA and you want to relax, you can. But only for a while. It's not just about the terms of the contract, but also about how the purchase price is paid in practice.

If the payment period is correctly specified in the contract, but in practice payments are made later than in 30 days, this also constitutes a breach of the SMPA. It is irrelevant that the buyer is also exposed to a contractual penalty for late payment in such a case.

It should be noted that the decisive moment for payment is the time when the supplier can dispose of the funds, i.e. typically the time when the money is credited to the supplier's account. This is regardless of whether the customer pays the invoice directly or uses a third-party clearing service.

It is also necessary to avoid any artificial extension of the agreed payment period. For example, by creating delays in the acceptance of goods after they have been delivered by the supplier to the buyer's warehouse in a situation where the invoicing is linked to this acceptance[4]. Or by refusing to accept an invoice on the grounds that it contains errors. Of course, if the errors are such that payment cannot be made, this must be accepted. However, if these errors are of a formal nature, or if there is simply an internal process for checking the accuracy of the invoice which unreasonably delays the point at which it is deemed to have been delivered, this could be considered a breach of the SMPA.

The payment period is a complex issue and its specification can often be quite problematic. If you have any questions, please do not hesitate to contact us and we will be happy to assist you.

WHAT TO REMEMBER?

- Even after the amendment to the SMPA becomes fully effective on 1 January 2024, the buyer with significant market power will be allowed to agree on a payment period up to 30 days from the delivery of the invoice for the goods supplied.

- It is of course possible to adjust the timing of the delivery of the invoice so that it follows the delivery of the goods. However, the time limit must not be artificially extended to the detriment of the supplier.

- It is expected that monitoring the correct payment period will be one of the Office's priorities in the coming year.

AND WHAT'S NEXT?

- Next time we will look at services, especially those provided by the buyers, such as accounting services or sales support.

- [1] – Decision of the Office of 24 April 2013, no: ÚOHS-S160/2010-7578/2013/460/APo in the case of Kaufland Česká republika v. o. s. and the decision of the President of the Office of 21 October 2013, no: ÚOHS-R146/2013/TS-20430/320/RJa.

- [2] – Judgment of the Regional Court in Brno of 21 April 2016, No. 30 Af 125/2013-191.

- [3] – See 2022 Sector Inquiry Report; https://www.uohs.cz/download/VTS/Zprava_Sektorove_setreni_2022.pdf.

- [4] – See the Report.