Employee stock ownership plans (ESOPs) are increasingly being talked about in the domestic context. However, the concept imported mainly from the other side of the Atlantic logically carries with it certain specifics that cannot be easily transposed to the Czech context. The following parts of the "Lex ESOP" series will explain how ESOPs work under Czech law. This first post in the series is a short introduction to the topic of ESOPs. The aim of this Lex ESOP series is to explain ESOPs in a very simple way, presenting their options, individual advantages and disadvantages, tax bases and much more. Welcome to the first post.

Employee stock ownership plans (ESOPs) enjoy considerable popularity on both sides of the Atlantic. According to available statistics, nearly 12% (over 14 million) of all U.S. employees participated in ESOPs in 2015. In Europe, nearly 8 million employees participated in ESOPs in 2017, holding stock in their employers worth a total of €389 billion.

The motivations that lead individual actors to participate in an ESOP are and will be addressed in more detail in the part "ESOP’s Leadership", in which we introduce the issue of ESOPs through the lens of shareholders but also of the managers themselves or individual companies (for completeness, we add that the last part of our ESOP campaign is "ESOP's Fables", where we present specific successful implementations of ESOPs by our clients). Even so, also for the purposes of this text, it is possible to peek slightly beneath the surface of the rationale for ESOPs.

According to the U.S. National Center for Employee Ownership (NCEO), firms offering ESOPs, among other things, significantly outperform firms not offering ESOPs, and have higher profitability. ESOPs then increase company performance by up to 5% on average.

A frequently mentioned disadvantage of ESOPs is their tax burden. This issue will also be discussed in more detail in the following parts - we can already indicate that although ESOPs are not significantly tax-favoured in the Czech Republic, it is not such a fundamentally bad situation as it is sometimes presented. Moreover, the motivation for implementing ESOPs lies in an area other than tax savings. However, we will go into more detail on statistics and motivations only in ESOP's Leadership.

Now, let's start with a complete introduction to ESOPs - what are the basic options offered and how do they differ?

Basic types of ESOPs

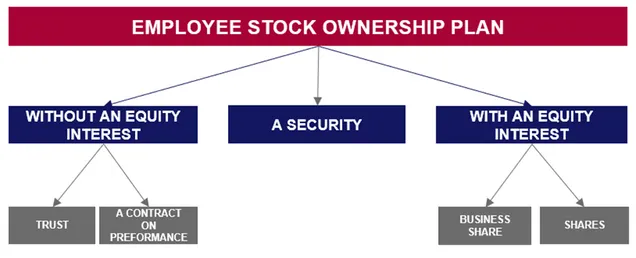

The classification of ESOPs can be approached from different perspectives. The individual types can generally be classified based on whether the managers pay any sum for the acquired asset, in what amount and when, on what conditions they acquire the asset, to what extent, etc. However, we consider the most natural criterion for classification to be a consideration of the type of an asset the manager acquires.

In principle, there can be three different cases. An ESOP may be represented by the option to (i) acquire an equity interest in the company (or its equivalent), (ii) acquire a security without an equity interest, or (iii) receive a managerial bonus that will be established purely by a contractual clause - typically in a contract on the performance of office. The difference in the individual approaches to an ESOP will be reflected to a large extent in the manager's motivation, so it is necessary to appropriately choose one of these options in relation to the founder’s expectations and how he wants to motivate the manager.

ESOP with an equity interest

Typically, the most comprehensive tool to motivate a manager will be an ESOP with an equity interest. In such a case, the manager will usually feel that he is "getting something in his hands" as part of the ESOP. This may have not only metaphorical, but also literal meaning. He may get to his hands a stock representing his particular shareholding in a joint stock company, or a capital contribution certificate representing his ownership interest in a limited liability company. By doing so, the manager can get not only a framed picture to his office wall, but also certain rights.

As a matter of fact, such equity interest necessarily attaches a shareholder's rights. These, as will be discussed later, can of course be modified significantly. However, the current shareholder must take into account that if this option is chosen, he will also meet the manager at the general meetings of the company, where the manager may interfere in the management of the company from "the top" in case of imperfect regulation of mutual relations.

As a rule, an ESOP with equity participation will be of a longer-term nature. This is the solution offering the most comprehensive regulation and our clients like to use this option when they are looking for regulation of their relations with managers for years to come.

Securities for managers

However, we also know from our experience that some clients do not want to give managers the opportunity to interfere with the management of the company through the general meeting and wish to strictly separate the spheres of ownership and management of the company. For them, a solution is offered through the acquisition of a special security. The latter will not carry with it an equity interest, but will still retain the advantage of the manager receiving something tangible and valuable. Such a security will then typically attach the right to yields from the company (or several companies, or the whole group), and logically the security itself may also increase in value over time.

As in the case of an equity interest, the manager's motivation in the case of a security may consist not only in regular yields depending on the current profitability of the company, but also in the yield on the manager's final exit from the company. In an exit, the original shareholder usually buys the security (or equity interest) from the manager, even at a premium price, and thus managers are not only motivated to achieve short-term profitability, but also long-term growth in the value of the company. This also balances the risk of managers taking too risky decisions in the pursuit of short-term profits.

ESOP without an equity interest

Last but not least, an ESOP without an equity interest offers a more sophisticated solution (e.g., in the form of a management trust), but also a simple one in the form of a simple contract on the performance of office. This may include a comprehensive regulation of bonuses so that their payment is linked to the performance of the manager in order to motivate him as much as possible.

His remuneration can thus be linked to the company's performance in a similar way as if he held an equity interest in the company, but everything will only take place on the basis of the contract on the performance of office. This is why this solution is also sometimes referred to as phantom shares. Compared to the previous options, however, this will generally be the most flexible solution, but with the highest tax burden.

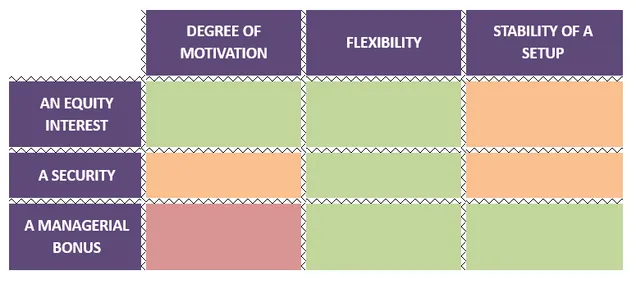

Comparison of individual options

The individual options can be simplistically compared with respect to the degree to which they can motivate the manager, their flexibility and the stability of the set-up as described below.

As we already indicated in the introduction, you can look forward to a more detailed explanation of each option in the next posts