Slovakia’s foreign direct investment (FDI) screening regime came into force on March 1, 2023. As decisions of the Slovak Ministry of Economy (MoE), a competent authority enforcing the regime, are not public, only limited information as to how the regime functions in practice has been available so far. This has changed with the MoE’s first report on the enforcement of the Slovak FDI Act, published on June 26, 2024. In this post, we summarize the report’s key insights.

HAVEL & PARTNERS has a dedicated team of lawyers focused on the FDI practice in Slovakia. We regularly advise clients on FDI issues and represented them in several proceedings before the MoE. If you have any question or comments regarding Slovak FDI regime, please feel free to reach out to us.

Background - Slovak FDI regime

The Slovak FDI regime applies to non-EU investors investing, directly or indirectly, in Slovak targets.

The regime distinguishes between critical and non-critical investments. Critical investments include sensitive sectors, such as manufacturing of military products, dual-use items, healthcare biotechnology, certain digital and media services, or critical infrastructure. These investments must be cleared by the MoE before their implementation, i.e., pre-closing.

Non-critical investments include all investments that are not considered critical. These are not subject to pre-closing clearance, but the MoE may decide to review them on its own initiative (ex-officio) within two years after closing. Foreign investors may avoid an ex-officio review by submitting a voluntary notification.

In its review, the MoE assesses whether the investment may have any negative impact on security and public order in Slovakia. Depending on the review’s outcome, the MoE may either block the investment, impose remedies, or clear the investment.

Non-compliance with the FDI Act is subject to fines, which the MoE may impose repeatedly. Depending on the type of an FDI Act violation, the maximum amount of fine may range between 1–2% of the foreign investor’s total turnover.

MoE’s report

The report covers the period of March–December 2023 (no general FDI regime was in place in Slovakia before).

The report includes the statistics on:

- The number of foreign investment reviews, their outcome, and duration;

- The geographical origin of foreign investors;

- Sectors in which foreign investors invested; and

- The MoE’s procedures concerning FDI Act violations.

Number of notifications, outcomes, and duration

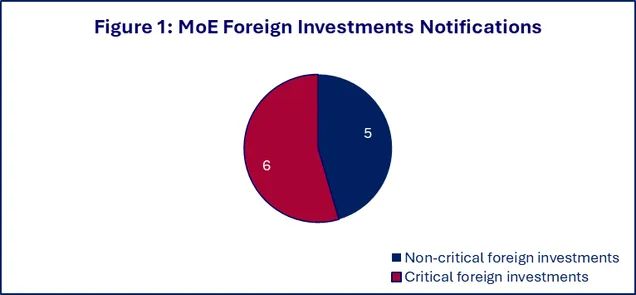

In the reported period, foreign investors submitted a total of 11 notifications, out of which:

- Six notifications concerned critical foreign investments (obligatory notification);

- Five notifications concerned non-critical investments (voluntary notification).

The MoE identified no risk of negative impact in any of the notified investments – all were cleared without remedies.

The MoE did not initiate any ex-officio reviews in 2023.

In terms of duration, review of critical investments took 95 days on average. Review of non-critical investments – which, if no risks are identified, are reviewed in a simplified procedure – took 59 days on average.

Origin of foreign investors

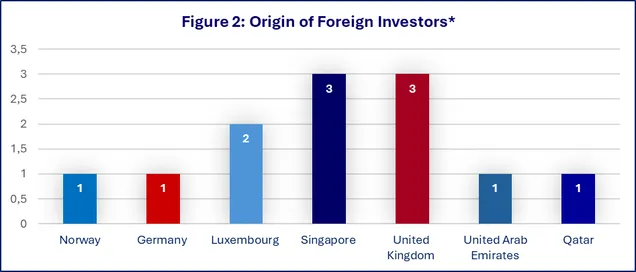

The investors notifying their investments in Slovakia came from various countries. Most investors were from Singapore and the UK – three from each of them. None came from either China or Russia, which tend to be investigated more closely under the EU FDI regimes. The full overview of foreign investors’ origin is shown in Figure 2 below.

*Note that while investments by EU investors (e.g., from Germany or Luxembourg) are generally not notifiable in Slovakia, they may be subject to the Slovak FDI regime under certain circumstances, for example, in cases where the EU investor is controlled or financed by a foreign government. Investors from multiple countries may be part of a single notified investment.

Sectors receiving notifiable foreign investments

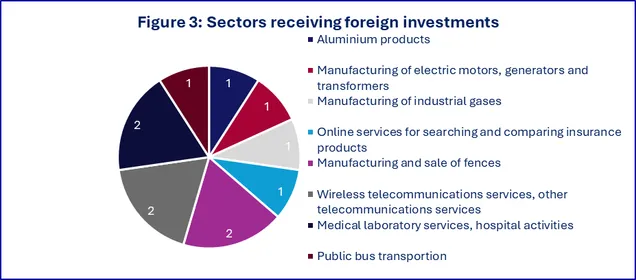

Notifiable investments concerned a range of sectors. There does not seem to be a pattern in terms of a specific sectors being subject to the review as no more than two investments concerned a single sector. We provide the full overview of the sectors receiving notifiable foreign investments in Figure 3 below.

FDI Act violations

In 2023, the MoE opened no administrative procedures concerning suspicion of FDI Act violations.

Our comment and outlook for 2024

The introduction of the Slovak FDI regime can be considered a success. The FDI Act created a functional framework for review of foreign investments, and the MoE strived to make the process transparent by being open to informal consultations and by issuing a FAQ document, addressing some of the issues on which the FDI Act is unclear. The MoE used the new powers under the regime with restraint. The required level of detail in notifications, at least in our experience, was proportionate and did not surprise the investors. The MoE did not interfere in any investments in 2023 – although none of the investments reviewed were from sensitive countries, such as Russia or China.

For 2024, the MoE’s report expects the number of notifications to increase. This is mainly because (i) the improved Slovakia’s economic outlook; (ii) increased investors’ awareness of the Slovak FDI screening regime; and (iii) the introduction of FDI screening regimes by additional EU Member States (which may point to issues also in Slovakia leading to notifications or ex-officio reviews). These expectations seem realistic.

Finally, the MoE expects to amend the FDI Act, primarily in response to the planned new EU Regulation reforming current Regulation No. 2019/452. This will provide the MoE an opportunity to reassess the FDI review process and improve any of its shortcomings.

Overall, FDI screening is increasing in importance, across the EU and in Slovakia. While FDI has not been in the spotlight in Slovakia yet, given the lack of problematic notifications, it is only a matter of time. Neighboring countries – in particular Austria, Czechia, and Hungary – have already interfered in transactions through their FDI regimes. The Slovak FDI regime is thus worthy of attention for any investors with non-EU origins. HAVEL & PARTNERS team stands ready to assist.